CASE MANAGER JOB DESCRIPTION

1. Handle potential new client intakes – Input detailed and accurate information into lead docket, collect and upload important case documentation, express empathy and passion for clients needs. Use DocuSign for all client engagement documents and ensuring return within 48 hours.

2. Set up referrals for clients – To medical providers, body shops, and potentially refer unqualified leads to other firms.

3. Assist clients with Property Damage – Work with client, body shops, Insurance PD adjustors, towing companies, and rental car companies. Handle most of the communication with all parties involved, follow up on status, fight for rental car extensions, and walk cent through entire Total loss process. Dealing with Vehicle titles and power of attorney/release of interests forms from the DOL.

4. Filevine Client Case Management – Manage all client files. Ensure file organization of detailed and correct client contact and case information.

5. Medical Records Management – Ensure all client treatment provider records are requested, followed up on, received and uploaded. I Utilize Chartswap, Ciox, and Fax to accomplish these tasks along with paying for invoices.

6. Client Experience – Guaranteed exceptional customer service. Provide client updates on a consistent basis and try to make sure we call our clients before they call us. Client communication is as follows: Follow up with clients to ensure consistent medical treatment, follow up with clients to provide updates on case status, follow up with clients to express empathy, follow up with clients to answer questions. Always going above and beyond to help clients recover the most money and have a stress-free post-accident experience.

7. Documentation creation, submission, and retrieval – This entails everything from police reports, wage loss documents, letters of representation, notices of withdrawal, written statements, and many more. It is my job to ensure all required documents are sent to the insurance companies and clients along with making sure our firm has all the necessary documents for demand.

8. Firm technology manager??? – Take lead on website development and upkeep, Filevine/Lead Docket issues, any other software/technology issues that may arise for team members.

9. Firm Brand Ambassador – Represent firm with the utmost respect, loyalty and hard work. Increase 5-star Google Reviews, share Law Firm material with others, hand out business cards to try and grow the business.

Client Intakes

First, I sit down or am over the phone with a client, and tell them a little bit about myself as a case manager for Habtemariam Law. I express my empathy for their situation and explain that we are equipped with the experience and tools needed to help them with their case.

I then ask them to just explain to me what happened and try to listen as closely as possible, picking up on any and all details.

I then walk them through all of our intake questions, making sure to gather all necessary information and input into to Lead Docket.

Based off the type of case, my next steps are different. If the case is strong and something we are familiar with or liability has already been established, my goal is to sign them up right then and there. I would proceed to explain exactly how I would help them with their case and the value I add. I reassure the client that I am here to help them have the most stress-free post-accident process possible. I then work to have them sign the contract and HIPPA form right away before they leave or hang up.

If the case is iffy or if the liability is not clear, I still explain to the potential client what my role would be in their case and that we are equipped to help them, but I express that my team and I will have to investigate and confirm liability before signing up the client. I have them sign the Authorization to investigate form.

If the case is an unqualified lead, I make sure to still listen to their concerns and advise them on best next steps. I will also make sure to refer them to the right people that may be able to better assist them then our firm.

Potential red flags to look out for during an intake are as follows

1. Police report putting our client at fault

2. Police never showed up/Called and it’s a “he said” “she said”

3. Client has waited more then 2 months to start treating for “injuries” or is unwilling to treat with a medical provider

4. Client

Property Damage

Property damage is not straight forward, or clear cut and every accident, case, or insurance company handles property damage differently. PD is always dependent on something. It depends on if our client has 1P collision coverage, it depends on if 3P insurance covers rental cars or cuts a loss of use check, it depends on if the car is a total loss or repairable. There are so many factors involved including body shops, tow yards, insurance companies, vehicle types, and client’s flexibility.

To begin the process of solving property damage, you have to confirm with your client a few important details

1. Where is the vehicle located?

2. Pictures of the damage to their vehicle

3. Is the vehicle drivable?

4. Do you own the vehicle or is there a lean on it?

5. Was there any existing damage to the vehicle?

6. Was it towed? Which towing company?

7. Is the vehicle in your name? Do you have the title?

8. Do you have a preferred body shop, or can we use one local to you or can we use a repair shop that is recommended from the insurance company? (It is the clients right to have their vehicle repaired wherever they choose)

9. Do you have collision or rental car coverage through your 1P insurance?

Once you have all these questions answered, you can begin the process of working with the insurance companies assigned PD adjustor.

The goal is to get the client vehicle inspected and evaluated as soon as possible to mitigate costs and determine if the vehicle is repairable or a total loss.

If the vehicle is repairable, getting that vehicle set up with a body shop and having our client set up with a rental car is the ultimate goal. Hopefully, if no issues arise (which is often not the case) then the car is taken to the shop, parts ordered, client gets rental car until vehicle is finished with repairs, insurance company pays body shop, client gets vehicle back and returns rental. There are more details and complications that may arise through supplemental estimates and what not, but that information is learned over time and experience.

If the vehicle Is a total loss, it is important to have the client remove all personal property from the vehicle and to retrieve the vehicle title. The insurance company will assign a total loss adjustor and they will utilize a system and an inspection to create a market evaluation report. This report outlines vehicle value based off year, condition, and mileage, along with the value of similar vehicles in the local area. I will review this report with my client and my client will have the option to relinquish the vehicle to the insurance company or to keep the vehicle and pay a small fee. Paperwork will ensue depending on the client choice.

Medical Records

Requesting medical records for our clients is crucial to the success of our firm and our clients’ cases. To request records for our clients, we need them to sign our HIPPA authorization/release of information. This document allows our firm to request, access, and review the information from our client’s medical treatment providers. For the HIPPA document, we must remember to edit the expiration date to reflect the Statute of Limitations, which is 3 years from the date of the accident for cases in Washington State. Without this, the form expires after 90 days of signature date.

The next important item to remember about requesting medical records is time. Medical providers are usually always behind, and it is extremely vital for us to submit our medical records requests to treatment providers as soon as we know our client has completed their treatment with them. This is even more important when it comes to Hospitals, ER’s, Medical Specialists, and Ambulances, because they can sometime take 1-3 months to respond to our requests. A good habit and routine to get into with all new clients is to confirm all treatment providers they went to and ask for paperwork they may have received such as an after visit summary.

For all Hospital, Ambulance, and Medical Specialists that our clients went to for 1, maybe 2 visits, it is our goal to request those medical records within 3 days of that person becoming our client.

For all treatment providers such as chiropractors, physical therapists, or any other medical providers that our clients seen for an extended period of time, it is vital we request records within 3 days of finding out treatment completion.

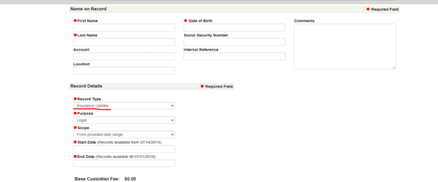

All medical records requests are to be submitted with a Request form template and a fully edited HIPPA authorization. Templates and training will be provided.

We utilize multiple systems in order to request and receive medical records such as Chart Swap, CIOX Health, email, and Fax. Each system operates differently and training will be provided.

REQUIRED ITEMS AFTER SIGNING UP A CLIENT

- A picture of the client’s driver’s license – the purpose of this is also for confirmation of birthdate and spelling of their legal name

- Police Report/Exchange of Information

- 1P/3P Insurance information to include name of driver, vehicle information, policy number;

- If your client went to a hospital after the accident, request they send you a picture of their “After visit summary” to confirm hospital name and location for records requests;

- Pictures of damage to our client’s vehicle;

- Wage Loss (if applicable) collect paystubs, request WLA right away from provider;

- Contract and HIPPA Authorization

HOW TO SUBMIT HEALTH HIPPA (Health Insurance Information) TO MEDICAL PROVIDERS VIA CHARTSWAP OR PHONE

- Gather Relevant Information:

- Collect all necessary health insurance details,(pictures of front and back of HI cards) including policy number, group number, and any other pertinent information.

- Phone Submission Steps:

- Call the medical provider’s billing department.

- Clearly state your purpose and express your intention to provide health insurance information.

- Provide all required details accurately, including policy and group numbers.

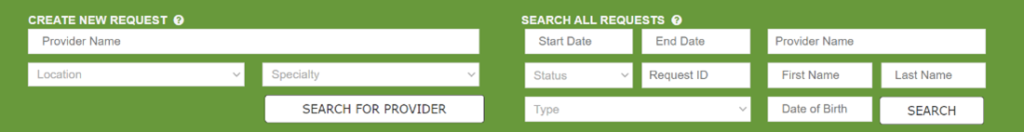

- Chartswap Submission Steps:

- Access the Chartswap platform and log in to your account.

- Identify the specific medical provider for submission.

- Enter Information on Chartswap:

- Input the required CL’s information

- select the insurance update option.

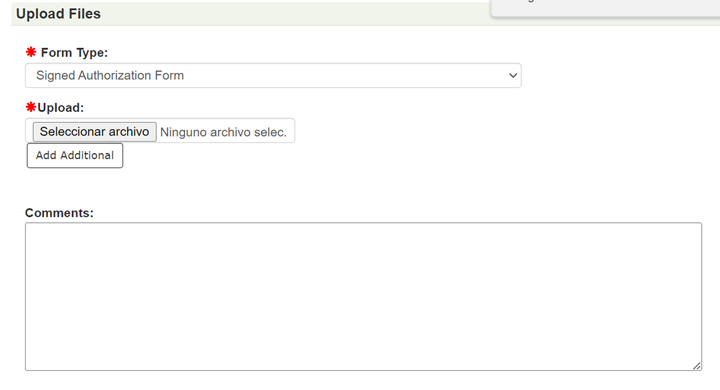

- Upload Supporting Documents:

- Click next and upload any supporting documents related to health insurance coverage, such as copies of insurance cards (front and back) and HIPPA

- Submit

- Once you have reviewed all the information is there you can submit the request

- Follow-Up:

- After submission, follow up with the medical provider to ensure they have received and processed the health insurance information.

- Address any additional requests or inquiries promptly.

- Documentation:

- Record the submission details, including dates, times, and any reference numbers, in your records for future reference.

HOW TO UP-DATE CLIENTS AFTER COMPLETING TREATMENT

Index:

Step 1: Once treatment is done go over the remaining process with your client

Step 2: contact client twice a month during the record collection.

Step 3: Contact client once you have received all records and will be sending the case to the legal team to draft the demand package.

Step 4: Contact client once a month if the demand package is taken long and update them on what is causing the hold up.

Step 5: Contact client once the demand package is sent out.

Step 6: Contact client if we never receive acknowledgment from the insurance or if the demand package had to be resent.

Step 7: Contact client when we receive offers

Step 8: Contact client once we receive final and last offer

Step 9: Contact to go over the accounting and have client decide if they would like to settle with the final offer or if they want to take it to court to try to get a higher settlement.

HOW TO DO BILLING VERIFICATION

HOW TO VERIFY HEALTH INSURANCE SUBROGATION OR LIEN

HOW TO HANDLE CASES THAT ARE UNDER INVESTIGATION

Objective: To diligently investigate and establish fault in auto accidents to determine the viability of representation.

Step 1: Initial Client Interaction and Information Gathering

1.1 Collect Basic Information:

- Gather contact information from the potential client.

- Record details of the accident, including date, time, and location.

1.2 Obtain Both Parties’ Insurance Information:

- Request insurance details from the potential client. If no information for Third-Party, wait for the police report to be released.

- If a claim hasn’t been opened, guide the client in initiating the claim process.

1.3 Provide Comprehensive Information to the Insurance Company:

- While opening the claim, furnish all relevant accident details to the insurance company.

Step 2: Immediate Actions to Support Investigation

2.1 Referral to Chiropractor:

- Recommend a chiropractor based on the client’s preferred location.

- Emphasize the importance of prompt medical attention.

Step 3: Formalizing Representation

3.1 Send Letter of Representation:

- Draft a formal letter of representation on behalf of the law firm.

- Send the letter to both parties’ insurance companies.

Step 4: Obtaining Essential Reports

4.1 Acquire Police Report:

- Check for the availability of a police report.

- Obtain a copy if available, and thoroughly review its contents.

Step 5: Addressing Lack of Clarity in Fault Determination

5.1 No Police Report or Clear Fault Determination:

- Investigate further in the absence of a police report or clear fault determination.

- Identify potential witnesses or surveillance cameras at the accident scene.

Step 6: Communication with Insurance Companies

6.1 Submit Comprehensive Information:

- Compile all gathered information, including medical reports and witness statements.

- Submit this comprehensive package to both insurance companies.

6.2 Consult with Third-Party Adjuster:

- If liability remains unclear, engage with the third-party insurance adjuster.

- Inquire about specific information needed to determine liability.

Step 7: Decision on Case Acceptance

7.1 Response from Third-Party Insurance:

- If the third-party insurance accepts liability, proceed with informing the client.

- Communicate the next steps, including initiating medical treatment and the legal process.

7.2 Denial of Liability:

- If the third-party insurance denies liability, inform the client of the decision.

- Clearly communicate the inability to take on the case due to insufficient evidence.

Step 8: No Third-Party Insurance or Denial of Liability

8.1 Check for UIM Coverage with 1st Party Insurance:

- In case of no third-party insurance or denial of liability, check the client’s 1st party insurance for Underinsured Motorist (UIM) coverage.

- Confirm that the third party is at fault before proceeding.

Step 9: Moving Forward with Representation

9.1 Obtain Client’s Consent and Signature:

- Provide the client with the necessary legal documents, including the contract and HIPAA forms via DocuSign.

- Ensure the client signs and returns the required documents.

Note: Maintain clear and open communication with the client throughout the investigation process. Document all interactions, findings, and decisions for future reference and compliance in Filevine.

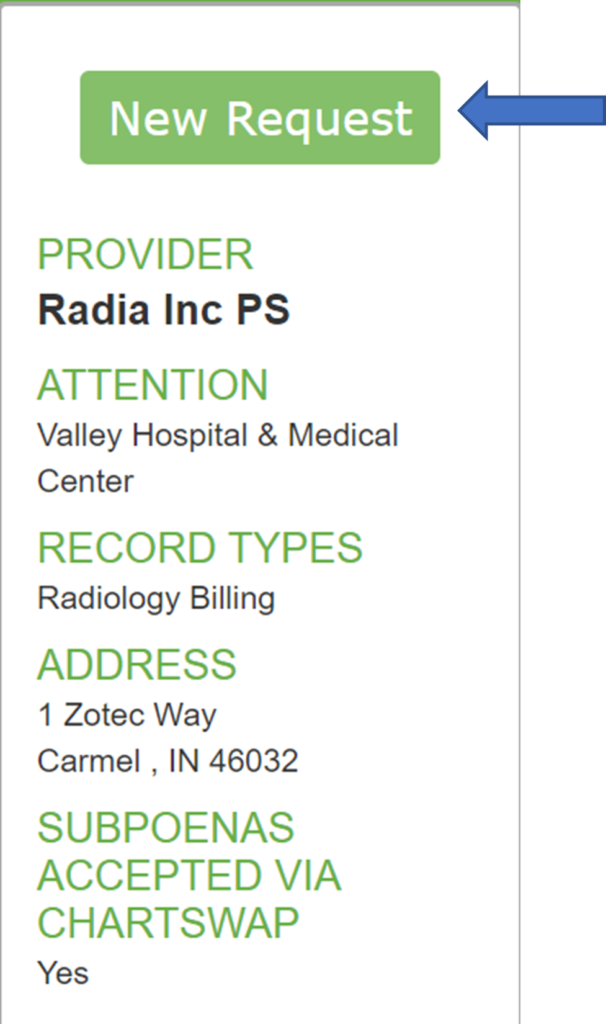

HOW TO REQUEST PHYSICIAN RECORDS

INDEX:

Step 1: Open Chartswap and Login

Step 2: Find the Provider for the hospital

Step 3: Open Sejda and Login

Step 4: Download the client HIPPA form from Filevine if it has not been saved to your desktop yet.

Step 5: Go back to Sejda and Edit the HIPPA form

Step 6: Go back to chart swap and submit request

Step 7: Go back to Filevine and upload Physician HIPPA form in record request

Step 8: Go to communications and write a note that Record Request for Physician Billing has been requested

HOW TO REQUEST WAGE LOSS RECORDS & AUTHORIZATION

Index:

Step 1: After client is done treating ask them if they missed work due to pain or treatment

Step 2: Have client sent 2 months of pay stubs

Step 3: Fill out Wage loss Authorization and submit to chiropractor

H0W TO SOLVE A PD (PROPERTY DAMAGE) CLAIM

If the Vehicle is a Total Loss: After establishing liability with a third-party (3p) or underinsured motorist (UIM) claim, follow these steps:

- Call the cl to inform them that the liability has been accepted. Gather vehicle information such as its location and pictures of the damage.

- Contact the adjuster to inquire if they are prepared to initiate the vehicle inspection. They might ask for pictures of the damage or inquire if the car was towed from the scene to assess if it’s a potential total loss case.

- Provide all requested information to the adjuster.

- Request a rental car for the claimant. The adjuster will arrange this with a nearby Enterprise and provide a reservation number.

- Coordinate the pick-up time of the vehicle with the cl and the adjuster.

- After the vehicle is picked up, the inspection process will commence, taking approximately one to two weeks.

- Regularly follow up with the adjuster to ensure the inspection is completed. Consistent communication is essential as they might not promptly respond.

- Once the inspection and valuation are finished, the adjuster will email the valuation report, including actual cash value, adjustments, and the total settlement.

- Forward the valuation report to the cl and discuss the settlement terms. Advise the cl that total loss settlement is not negotiable. If the offer seems low, suggest they communicate directly with the adjuster and provide their information.

- If the cl accepts the offer, call the adjuster to request the total loss documents for signature.

- These documents provide instructions for signing the title and releasing interest. Have the cl sign the documents and title.

- Return the signed documents to the provided return address.

- Follow up with the adjuster to confirm receipt of the documents.

- Upon receiving the documents, the adjuster will issue payment to the cl’s preferred address.

- Check back with the cl after seven days to verify receipt of the check. Once confirmed, the total loss claim will be resolved.

If the Vehicle is Repairable: Once liability is established with a third-party (3p) or underinsured motorist (UIM) claim and the vehicle is deemed repairable, follow these steps:

- Call the cl to inform them about the accepted liability and gather vehicle information, such as location and pictures of the damages.

- Contact the adjuster to determine if they are ready to proceed with the estimate.

- Most insurance companies prefer to conduct their own estimates. They work with preferred body shops for this purpose.

- Estimates can be done through photo assessment, where the insurance company sends a link to the client’s phone for them to submit pictures, or in person by sending an estimator to the vehicle’s location.

- Set up an estimate appointment based on the client’s preference.

HOW TO SOLVE DIMINISHED VALUE

Step-1: Inform the Client (CL):

- Clearly explain the fee structure to the client, emphasizing the additional 33.3% charge.

- Ensure the client understands the process and fees involved.

Step-2: Contact the PD (Property Damage) Adjuster:

- Call the PD adjuster to initiate the property damage (PD) process.

- Express your intention to start the diminished value (DV) process.

- This communication can be done over the phone or through email.

Step-3: Submit Documents to Adjuster:

- Provide the PD adjuster with necessary documents, such as estimates.

- Be prepared for additional requests, such as filling out forms.

Step-4: Follow Up with Adjuster:

- Since adjusters may take time, follow up to ensure the process is moving forward.

- Promptly respond to any additional requests for information.

Step-5: Review Adjuster’s Offer:

- Once the adjuster provides an offer, review it.

- Discuss the offer with the client to determine if it’s acceptable.

Step-6: Use Diminished Value Assessment Website:

- If the client is dissatisfied, use https://www.diminishedvalueassessment.com to compare the amount offered.

- Note that there may be a fee for using this service.

Step-7: Negotiate with Adjuster:

- Submit the assessed amount to the adjuster and attempt to negotiate a higher settlement.

- Keep the client informed during the negotiation process.

Step-8: Release Agreement:

- Upon reaching an agreement, the adjuster will send a release agreement.

- Have the client sign the release and send it back to the adjuster.

Step-9: Payment to Law Firm:

- Once the adjuster receives the signed release, they will issue payment to the law firm.

- Ensure the check includes both the law firm and the client’s name.

Step-10: Client Payment:

- After deducting the 33.3% fee, the law firm issues a check to the client.

- Notify the client when the payment is ready for pickup or delivery.

Step-11: Final Notification to Client:

- Once all payments are processed, notify the client that the entire claim process is complete.

This process involves effective communication with the client, collaboration with the adjuster, and careful handling of paperwork and negotiations. Always ensure transparency and keep the client informed at each stage of the diminished value claim process.

HOW TO GATHER CLIENT STORY

List of Questions to use when Gathering Client Story Material

- Do you still experience any pain and how does that pain affect you on a daily basis?

- What was your life like before the accident? Were you very active, go on a lot of trips, what hobbies did you do?

- What activities did you do before the accident that now you are unable or avoid because of the pain this accident has caused? (Tennis, Gym, Running, Soccer, Cooking, Laundry..)

- How has your job been different? Do you feel pain in certain areas of your job?

- Have you at any point had to take reduced hours or sick days at work to help recover?

- Has your work placed you on any restrictions?

- Have you had to have any friends or family members help you in any part of your daily life activities?

- Have you had to hire anyone to help you around the house because of the accident? (Gardener, Cleaning person).

- How has your relationship changed if at all with your friends or family?

- How do you feel your mood has changed due to the accident? Do you feel more stress or anxiety in life?

- Have you had to use any braces for your arms or legs or walking canes?

- What fears do you have now while driving since the accident?

- Do you feel you need more treatment like physical therapy or massage?

- Do you have any bruises or scarring from the accident?

- Is there anything else you want us to know when preparing your client story to help explain the ways you have been affected as a result of this car accident?

HOW TO DO CASE REVIEW

WHAT TO SAY TO CLIENTS WHEN WE RECEIVE NEW SETTLEMENT OFFERS

- Hello (Client Name) I hope you are doing well. As you know your case is currently being negotiated. At this time, the insurance company has evaluated your case and provided us an initial settlement offer of $Blank. This is a gross offer before your medical expenses and attorney fees. My Pre-Litigation team is going to work to fight for you and we will continue to update you as new offers come in. Once we get a final offer my Pre-Litigation team will review an accounting with you. Please let me know if you have any questions. Thank you!

Please avoid saying things like “this is a bad offer” or “this offer is low, and we will negotiate a higher settlement for you” or “do you want us to accept this offer?”.

If your client has questions about their negotiation settlements, please let Joseph and his team (Sebastian, Maria) know and we would be happy to schedule a call with them to discuss their case.

As new offers come in, please let your client know the following.

“Hello client name, I hope you are well. My pre-Litigation team is still working on your case and the insurance company has provided a new gross settlement offer of $blank. We will continue to work on your case and reach out if we have any questions for you! Thanks!”

If any client becomes upset or angry its mostly because they probably don’t understand how these things work or we are missing something like wage loss, so just advise that if they would like you can schedule a call with our pre-lit team so we can help explain it to them.