CHECK LIST-WHAT TO ACCOMPLISH BEFORE YOU NEGOTIATE AND SETTLE A CASE

☐ Have call with Client to confirm all treatment providers, confirm all dates of service, discuss reasoning for any gaps in treatment.

☐ Do full medical record review to confirm all of client’s injuries (check for serious injuries)

☐ Confirm wage loss (How much time missed, what was approved by doctor, confirm exactly how much wage loss to the dollar)

☐ Obtain and use detailed client story in negotiations.

☐ Confirm if client is still in pain or if client is fully healed.

☐ Create accounting and update it as you get new offers.

☐ Communicate new offers to client (make sure case managers are accomplishing this)

☐ Confirm balance verifications are completed for all providers (HI liens, PIP, L&I etc.)

☐ Try to reduce medical bills if possible/necessary and send PIP Subrogation waivers (Get Supervisor approval)

☐ Try to get an understanding of client settlement expectations, what do they want in their pocket?

☐ Be sure to leave yourself a $10,000-$20,000 buffer for settlement for non-commercial cases and a $50,000 – $100,000 buffer for commercial cases – when you have signed accounting from client, work to obtain more money to surprise client.

☐ Get accounting signed and settlement approved by client before requesting final offer and release.

☐ Confirm all claims relating to property damage is resolved.

WHAT TO SAY TO CLIENTS WHEN WE RECEIVE NEW SETTLEMENT OFFERS

- Hello (Client Name) I hope you are doing well. As you know your case is currently being negotiated. At this time, the insurance company has evaluated your case and provided us an initial settlement offer of $Blank. This is a gross offer before your medical expenses and attorney fees. My Pre-Litigation team is going to work to fight for you and we will continue to update you as new offers come in. Once we get a final offer my Pre-Litigation team will review an accounting with you. Please let me know if you have any questions. Thank you!

Please avoid saying things like “this is a bad offer” or “this offer is low, and we will negotiate a higher settlement for you” or “do you want us to accept this offer?”.

If your client has questions about their negotiation settlements, please let Joseph and his team (Sebastian, Maria) know and we would be happy to schedule a call with them to discuss their case.

As new offers come in, please let your client know the following.

“Hello client name, I hope you are well. My pre-Litigation team is still working on your case and the insurance company has provided a new gross settlement offer of $blank. We will continue to work on your case and reach out if we have any questions for you! Thanks!”

If any client becomes upset or angry its mostly because they probably don’t understand how these things work or we are missing something like wage loss, so just advise that if they would like you can schedule a call with our pre-lit team so we can help explain it to them.

Click to download:

NEGOTIATING WITH 3RD PARTY (At fault Insurance Company)

- Complete Case Review (See Case Review 101)

- Create an accounting draft that you save in a folder so you can update throughout the negotiation phase.

- Determine if the at fault insurance company is a commercial carrier or not. A commercial insurance policy is often held by a business or a trucking company.

- In it is not a commercial carrier, then you are dealing with common insurance companies, ones that you see advertise with commercials on TV (Geico, Progressive, State Farm, Liberty Mutual, Allstate etc.) These insurance companies have “adjustors” whose sole responsibility is to pay the least amount of money possible on any given claim. They conduct their own case review, determine a settlement value of a case based off of injuries, reasonable treatment, proven wage loss, and similar accidents with similar injuries their database shows them. The adjustors will do whatever it takes to settle the case for as little as possible.

- With the above knowledge in mind, it is our job to fight for our clients and ensure they receive fair compensation for the accident/injuries they suffered. We do this through providing the human element to the case and introducing our clients story within negotiations, outlining factual proof of wage loss and medical bills, and arguing our clients case settlement value to be as high as possible.

- Please note that these non-commercial insurance carriers have different levels of policy limits for bodily injury settlements. They differ from driver to driver and from state to state. For example, in the State of Washington, the minimum Bodily Injury Policy Limit a driver is required to have is $25,000. In the State of Texas, that amount is $30,000. While anyone can obtain a policy limit up to $1,000,000 or more, the average policy limit in the State of Washington is between $25,000 and $100,000 with 80% of drivers having the minimum. In Texas, almost 90% of our cases deal with the state minimum policy limit.

- To begin, you must determine a case value for your client. This differs from case to case. Every client, accident, injury, wage loss, and situation is different from the next so you must be diligent when determining the case value. My first step would be to schedule a call with your client, introduce yourself, and ensure you have all of the correct information. Confirm with your client their specirfic wage loss number, all medical providers, get reasonaing for any gaps in treatment, figure out if they are still in pain or still suffering today, and show empathyf or them and let them know you will fight for them.

- Once you have confirmed the above with the client, you must break down the Outstanding Medical Bill Total and Wage Loss, otherwise known as “Special Damages”.

- Next, you must determine if there is any future treatment needed or future cost of care.

- When doing these breakdowns and evaluations, I recommend sorting cases based off severity to help you determine case values. For example, if you have a client who had no hospital visit, chiropractic care only, and diagnosed with soft tissue injuries and minimal wage loss, this case is valued as a low-level case. In this situation, your target settlement goal should be a final settlement that is 3-4X the current outstanding medical expenses. So, if you have a chiropractic bill for $5,000, then a total settlement between $15,000 and $20,000 would be ideal.

- Every case is different however, so in that same case where the client also had a concussion and was treated at TBI clinic, the value is not 3-4X the medical expenses, instead that value significantly increases.

- Additionally, a case where a client has a fracture, broken bone, TBI diagnosis, these would fall under an extreme severity evaluation. A settlement for anything less then the policy limits on these cases is a fail (depending on the policy limits of course).

RULES

- Rule #1 – You, or the Case manager, must relay all settlement offers to your client.

- Rule #2 – You will not finalize a settlement of a case unless you have your client’s approval (a signed accounting).

- Rule #3 – You will use a client story to provide the human element to the insurance company in your negotiations.

- Rule #4 – You will seek help from your team or supervisor if something is confusing or concerning.

- Rule #5 – A settlement that looks “good” to you, may not be the same for the client. Everyone has different levels of expectations with your client, discuss these with them before finalizing settlements.

- Rule #6 – You will always leave yourself a $10,000 buffer of room to negotiate with on normal cases and $50,000 buffer on commercial cases.

- Rule #7 – You will confirm all outstanding medical bills are included in your accounting and are accurate before sending to your client for signature.

- Rule # 8 – You will not allow emotions to get involved in your negotiations.

- Rule #9 – You will be professional in all correspondence with the insurance company. Present yourself as strong and always fight for your clients.

- Rule #10 – Always give the insurance company a deadline to respond by. This is a very important rule as it ensure the insurance company responds to us and if they don’t respond or ask for an extension, it leaves them open to a bad faith negotiations claim potentially.

The next steps involve negotiation responses.

- Once you have received an initial offer from the insurance company on a case, you must respond within 2 weeks.

- In our demand packages, our initial demand is for policy limits. Most of the time, that demand is unrealistic, but it allows the insurance company to provide us with their evaluation of the claim and provide a starting number to work from.

- If you know what the policy limits are, your first counter response should be simple and to the point. We want to send a counter demand with a number $5,000 less than the policy limits. So, for example, if the policy limits are $100,000, your first counter response should be for $95,000 and nothing else.

- Your counter response should look like this.

“State Farm,

Thank you for your initial offer of $15,000 to settle my client Steve Smith’s claim. After review and discussion with my client, this offer has been respectfully rejected. In a good faith effort to resolve this claim, my client has allowed me to counter with a demand of $95,000. Please provide a response within 5 days. Thank you”.

5. Be sure to post all counter responses to the clients Filevine account. Label the subject line as “counter response to (insurance company name)”.

6. We don’t want to include any other information in the first counter response because we don’t want to limit the negotiations and we want to see how the insurance company reacts/responds. In some cases, the adjustor may provide a second offer that increases by $5,000 – $10,000 without any new information. This is great and I highly recommend you continue negotiations this way until you “need” provide new information. In other cases, the new offer may be $500-$1000 higher or the adjustor may not offer a new amount at all and ask you to provide details as to why our client has their case valued that high.

7. In the latter, this is when we want to start fighting for our clients and pointing out important facts about the case. You want to address any areas of concerns the adjustor may have presented (reasons for gaps in treatment, wage loss clarification, medical bill questions) and then start to introduce the client’s story into your negotiations.

8. When negotiating with an insurance company, you want to be tactical. You don’t want to pour all of your “eggs into one basket” as they say. You may feel tempted to provide all the information possible to the adjustor in your initial email response but then that leaves you with no “ammo” to use down the line. I recommend using small pieces of information in each email to help keep negotiations trending in a positive direction.

9. As you continue negotiations and receive new offers, be sure to update your accounting accordingly to reflect the new numbers so you can track your client’s recovery progress. This will help you manage the case better and see how close or far you are from reaching your client’s settlement goals.

10. I want to emphasize again that some adjustors may only provide small increases to the settlement, while others may have larger increases, do not take this personally. Simply continue to negotiate and bring up the important points and facts and stay strong with your counter demands.

11. It is important to negotiate reasonably however, while keeping your cushion be sure to work towards the common goal of settlement. Your goal is to get the adjustor to their final offer and even beyond if possible.

12. When you are getting close or the adjustor has provided you with the final offer, be sure to review the accounting with your supervisor and discuss what the settlement looks like. You and your supervisor will determine any necessary medical bill reductions we need and will task Maria to accomplish those reductions.

13. Once we have responses to those reductions, it is best to review the accounting with your client.

14. It is important to empower the client. Present to the client that you are reaching out with an update and let them know what the insurance company has offered. Advise them of the reductions you were able to obtain and finally explain to the client how much money they would be getting in their pocket after medical bills and attorney fees are paid. Then ask them the magical question “Mr. Smith, what do you think?

15. If the client is happy, have them sign the accounting and advise them you will work to finalize the settlement.

16. If the client is not happy, be sure to ask the client why, what are they expecting to receive, and ensure that you have all of the details accurate (wage loss, medical bills, etc).

17. Meet with your supervisor to discuss possible avenues for the case moving forward.

Click to download:

NEGOTIATING WITH 1ST PARTY (With PIP)

- Complete Case Review (See Case Review 101)

- Create an accounting draft that you save in a folder so you can update throughout the negotiation phase.

- In these 1P cases where pip is involved, your accounting should simply reflect the settlement offer, attorney fees, costs and expense and client recovery as PIP should have paid all of the medical bills up to $10,000. If there are any remaining medical bills, please include these as well or work to have them waived.

- It is our job to fight for our clients and ensure they receive fair compensation for the accident/injuries they suffered. We do this through providing the human element to the case and introducing our clients’ story within negotiations, outlining factual proof of wage loss and medical bills, and arguing our clients case settlement value to be as high as possible.

- Please note that these non-commercial insurance carriers have different levels of policy limits for bodily injury settlements. They differ from driver to driver and from state to state. For example, in the State of Washington, the minimum Bodily Injury Policy Limit a driver is required to have is $25,000. The maximum PIP benefit in Washington is $10,000.

- In the State of Texas, that amount is $30,000. The PIP benefit in Texas is $2,500 (This is often MED PAY) While anyone can obtain a policy limit up to $1,000,000 or more, the average policy limit in the State of Washington is between $25,000 and $100,000 with 80% of drivers having the minimum. In Texas, almost 90% of our cases deal with the state minimum policy limit.

- There is only Hamms fee reimbursement for the firm in Washington when PIP is used. There is no reimbursement in Texas or when Med Pay is involved.

- To begin, make sure you have the final PIP ledger on file and that all of the medical bills have been paid or that PIP has been exhausted to its max of $10,000.

- Next, you must determine a case value for your client. This differs from case to case. Every client, accident, injury, wage loss, and situation is different from the next so you must be diligent when determining the case value. My first step would be to schedule a call with your client, introduce yourself, and ensure you have all of the correct information. Confirm with your client their specirfic wage loss number, all medical providers, get reasonaing for any gaps in treatment, figure out if they are still in pain or still suffering today, and show empathy for them and let them know you will fight for them.

- Once you have confirmed the above with the client, you must break down the Outstanding Medical Bill Total and Wage Loss, otherwise known as “Special Damages”.

- Next, you must determine if there is any future treatment needed or future cost of care.

- When doing these breakdowns and evaluations, I recommend sorting cases based off severity to help you determine case values. For example, if you have a client who had no hospital visit, chiropractic care only, and diagnosed with soft tissue injuries and minimal wage loss, this case is valued as a low-level case. In this situation, your target settlement goal should be a final settlement that is 3-4X the current outstanding medical expenses. So, if you have a chiropractic bill for $5,000, then a total settlement between $15,000 and $20,000 would be ideal.

- Every case is different, however, so in that same case where the client also had a concussion and was treated at TBI clinic, the value is not 3-4X the medical expenses, instead that value significantly increases.

- Additionally, a case where a client has a fracture, broken bone, TBI diagnosis, these would fall under an extreme severity evaluation. A settlement for anything less than the policy limits on these cases is a fail (depending on the policy limits of course).

RULES

- Rule #1 – You will communicate to the bodily injury adjustor in every negotiation response that this is a demand for X$ plus fees.

- Rule #2 – You, or the Case manager, must relay all settlement offers to your client.

- Rule #3 – You will not finalize a settlement of a case unless you have your client’s approval (a signed accounting). A settlement that looks “good” to you, may not be the same for the client. Everyone has different levels of expectations with your client, discuss these with them before finalizing settlements.

- Rule #4 – You will use a client story to provide the human element to the insurance company in your negotiations.

- Rule #5 – You will seek help from your team or supervisor if something is confusing or concerning.

- Rule #6 – You will always leave yourself a $10,000 buffer of room to negotiate with on normal cases and $50,000 buffer on commercial cases.

- Rule #7 – You will confirm all outstanding medical bills are included in your accounting and are accurate before sending to your client for signature.

- Rule # 8 – You will not allow emotions to get involved in your negotiations.

- Rule #9 – You will be professional in all correspondence with the insurance company. Present yourself as strong and always fight for your clients.

- Rule #10 – Always give the insurance company a deadline to respond by. This is a very important rule as it ensure the insurance company responds to us and if they don’t respond or ask for an extension, it leaves them open to a bad faith negotiations claim potentially.

The next steps involve negotiation responses.

- Once you have received an initial offer from the insurance company on a case, you must respond within 2 weeks.

- In our demand packages, our initial demand is for policy limits. Most of the time, that demand is unrealistic, but it allows the insurance company to provide us with their evaluation of the claim and provide a starting number to work from.

- In first party cases, we should have a DEC page on file so you should know what the policy limits are. Your first counter response should be simple and to the point. We want to send a counter demand with a number $5,000 less than the policy limits. So, for example, if the policy limits are $100,000, your first counter response should be for $95,000 plus fees and nothing else.

- Your counter response should look like this.

“State Farm,

Thank you for your initial offer of $15,000 plus fees to settle my client, your insured, Steve Smith’s claim. After review and discussion with my client, this offer has been respectfully rejected. In a good faith effort to resolve this claim, my client has allowed me to counter with a demand of $95,000 plus fees. Please provide a response within 5 days. Thank you”.

5. Be sure to post all counter responses to the clients Filevine account. Label the subject line as “counter response to (insurance company name)”.

6. We don’t want to include any other information in the first counter response because we don’t want to limit the negotiations and we want to see how the insurance company reacts/responds. In some cases, the adjustor may provide a second offer that increases by $5,000 – $10,000 without any new information. This is great and I highly recommend you continue negotiations this way until you “need” provide new information. In other cases, the new offer may be $500-$1000 higher or the adjustor may not offer a new amount at all and ask you to provide details as to why our client has their case valued that high.

7. In the latter, this is when we want to start fighting for our clients and pointing out important facts about the case. You want to address any areas of concerns the adjustor may have presented (reasons for gaps in treatment, wage loss clarification, medical bill questions) and then start to introduce the client’s story into your negotiations.

8. When negotiating with an insurance company, you want to be tactical. You don’t want to pour all of your “eggs into one basket” as they say. You may feel tempted to provide all the information possible to the adjustor in your initial email response but then that leaves you with no “ammo” to use down the line. I recommend using small pieces of information in each email to help keep negotiations trending in a positive direction.

9. As you continue negotiations and receive new offers, be sure to update your accounting accordingly to reflect the new numbers so you can track your client’s recovery progress. reaching your client’s settlement goals.

10. I want to emphasize again that some adjustors may only provide small increases to the settlement, while others may have larger increases, do not take this personally. Simply continue to negotiate and bring up the important points and facts and stay strong with your counter demands.

11. It is important to negotiate reasonably however, while keeping your cushion be sure to work towards the common goal of settlement. Your goal is to get the adjustor to their final offer and even beyond if possible.

12. When you are getting close or the adjustor has provided you with the final offer, be sure to review the accounting with your supervisor and discuss what the settlement looks like. You and your supervisor will determine any necessary medical bill reductions/waivers we need and will task Maria to accomplish those tasks.

13. Once we have responses to those reductions, it is best to review the accounting with your client.

14. It is important to empower the client. Present to the client that you are reaching out with an update and let them know what the insurance company has offered. Advise them of the reductions you were able to obtain and finally explain to the client how much money they would be getting in their pocket after medical bills and attorney fees are paid. Then ask them the magical question “Mr. Smith, what do you think?”

15. If the client is happy, have them sign the accounting and advise them you will work to finalize the settlement.

16. If the client is not happy, be sure to ask the client why, what are they expecting to receive, and ensure that you have all of the details accurate (wage loss, medical bills, etc).

17. Meet with your supervisor to discuss possible avenues for the case moving forward.

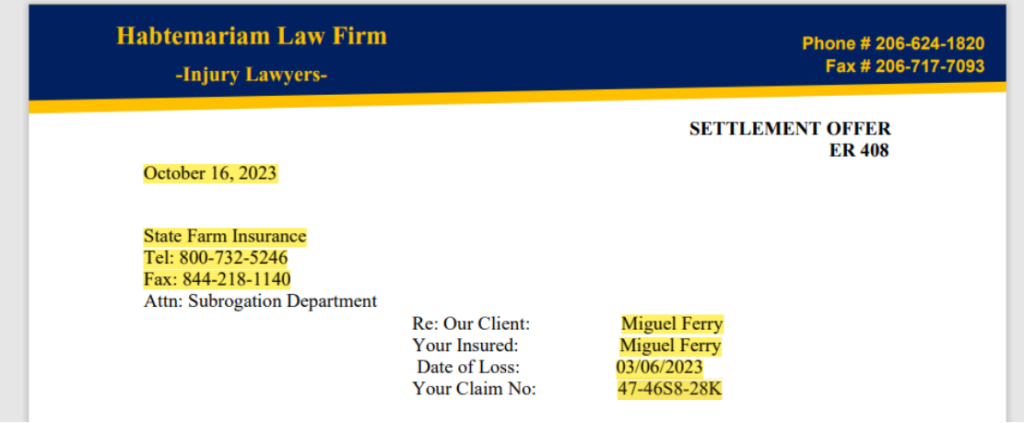

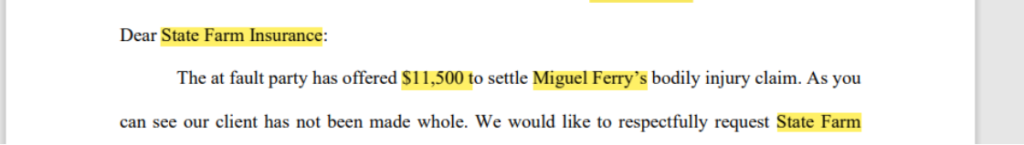

18. Once completed, you want to create the HAMMS fee excel spreadsheet and the offer acceptance letter. (See Hamms Fee Worksheet for Ref).

Click to download:

FINALIZING A SETTLEMENT WITH 1ST PARTY WITH PIP

- The first step in finalizing a settlement for a client’s case is ensuring the client is happy with the recovery and has signed the accounting.

- It is now time to request the settlement release from the insurance company. This is the time to try and obtain one final settlement offer for your client. You should have a $10,000 buffer that you have kept, and this allows you to now come down and try to obtain a final increase.

- For example, let’s say the settlement offer is $20,000 plus fees and the insurance company has stated this is their “top offer” or close to their top and you are sitting at a counter demand of $30,000 plus fees. At this time, it would be best to call the Bodily Injury Adjustor directly and have a conversation with them.

- I would start out that conversation in a friendly manner and thank the adjustor for working with you to try and obtain justice for your client/their insured. Advise the adjustor your client is ready to settle and that your client has a final settlement demand. (Based off how negotiations were going should determine where you feel comfortable trying to get a final increase).

- Next, tell the adjustor that you know we are $10,000 apart but my client wants to get this case resolved and they have told me they would be willing to sign the final release for a settlement amount of $22,000 plus fees. Is that possible? (Again, choose your number here wisely).

- The adjustor may respond in a few different ways. They could state “No” and that they have already provided you with their top offer and send you the release. They could state “well id have to get my supervisor to approve but I think the most I could do is $21,000”. In which you just got a $1,000 increase for your client.

- Or they could agree to your new demand and send you the final release. Which would be a $2,000 increase for your client. Of these 3 scenarios, the biggest part is your client is happy with either of them.

- If you receive any sort of increase it is important to revise your accounting and create a final draft that your client will sign. Once you have the final draft and the final release from the insurance company, you will send these documents to your client for the final signatures in DocuSign.

- In some cases, a release is not required by the first party insurance, in this case, you will just provide the insurance company with the offer acceptance and payment instructions.

- Call your client and surprise them with the new increase and have them sign the final documents. In this call, you want to highlight a few important things.

- First explain to them that the release is the document that allows you to request the final settlement check.

- Next, explain to the client that the settlement check takes 2 – 3 weeks to arrive in your office and that once the check is available, we will call them for pick up.

- Be sure to check your client’s address at this time and confirm with your client it is accurate. You want to ask your client if they would be able to pick up the settlement check from the nearest office location to them (SeaTac, Dallas, Shoreline, Yakima).

- If your client is unable to pick up the check in person due to distance or other circumstances, you can ask them if they would like the check to be mailed to them. You could also offer the client Direct Deposit as an option if the client banks with a major bank (Bank of America, Chase, Wells Fargo). If they do, gather their accounting and routing number and bank name.

- Once you have this information and the signed final settlement documents, you will create your settlement email to the insurance company. The email should look like the following.

“State Farm,

Please see attached breakdown of HAMMS fees and offer acceptance. Please follow the payment instructions outlined.

Thank you again for providing justice for my client Mahlet Hailesilasie. Have a great week and please advise when you have issued payments.”

Be sure to attach the signed release (if there is one), the Hamms Fee Breakdown Excel Sheet and the Offer Acceptance Letter (Do not send the accounting).

16. In some cases, the insurance company may request a copy of our firms W9, you may provide that to them as well.

17. Once you send the email, be sure to post this email to the clients Filevine account. Label the subject line as “release, offer acceptance, hamms fee breakdown and payment instructions sent to (insurance company name)”.

18. You can now change the Filevine case phase to “settled and Closing” and count this case as a settled case towards your scorecard.

PIP SUBROGATION WAIVER REQUEST:

Step 1: Identify which Insurance company you will be sending the PIP Subrogation waiver to.

Edit the following highlighted information:

- Date

- 1P Insurance Company

- Client name, D.O.L., and claim number.

Step 2: Edit the following highlighted information.

- insurance company (two places)

- Final 3P settlement offer amount.

- client’s name

Step 3: Insert the correct law firm expense amount. (This amount is usually the sum of the expenses folder, if there are no expenses assume it is $200).

You will then also note if there are outstanding balances in medical expenses or not, and whether the client has a wage loss claim. (if they do you will note the total amount).

If client does have outstanding medical expenses and if there is wage loss to claim, it should be inputted as follows:

Step 4: On the last page of the PIP Subrogation Waiver, you will have to change the name to the correct insurance company as well. Like shown below:

The final step will be to change the email address at the very bottom of the page, this should be your email address in case they need to contact you by email.

You will then email or fax the PDF document:

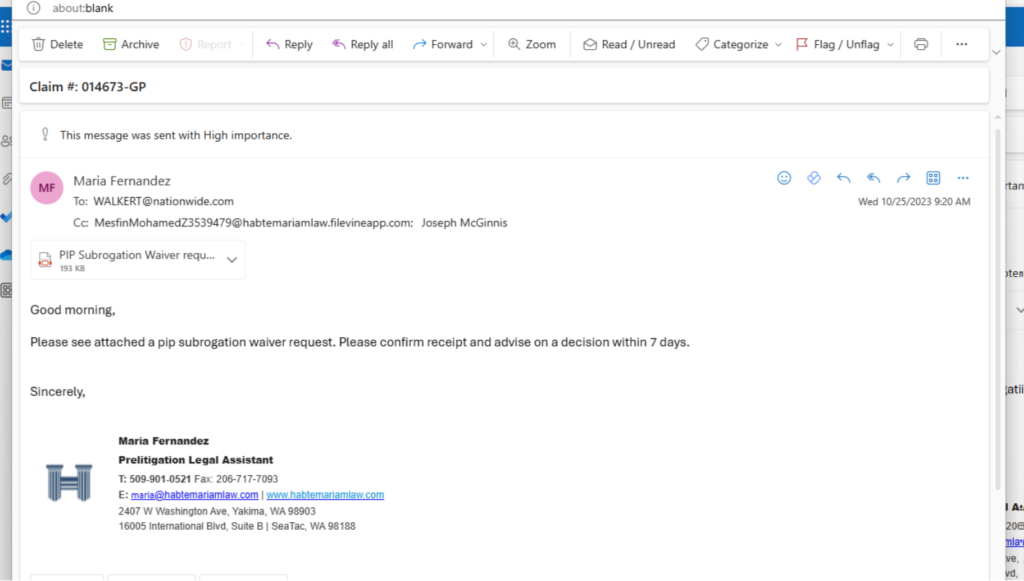

If you are emailing, attach the document to the email. The following is an example of how you should address the adjuster when emailing the PIP Subrogation Waiver:

Note: You will need to follow up with the Subrogation Department of the 1P Insurance company seven days after you have sent the waiver. You will need to continue to follow up by email and phone until you receive a response.

Click to download:

REDUCTION REQUEST

Reduction Request:

To fill out the Reduction Request, you will need to have the name of the provider along with the address, contact information and email address if available.

Step 1: Edit to responding provider.

- It is advised that you contact the provider to get the fax or an email address to send the reduction request. They will often have a separate billing department for this.

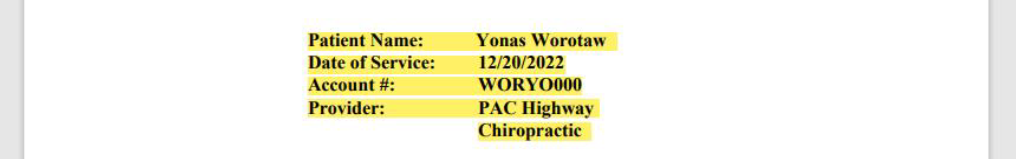

Step 2: Input the name of the client, date of service, account # on the billing records, lastly edit the provider to the correct one.

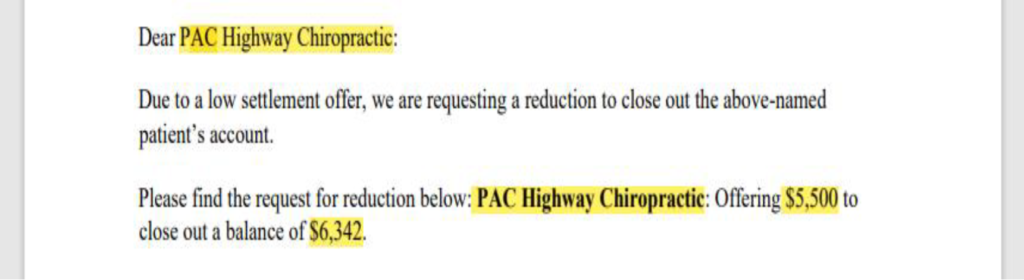

Step 3: Edit provider name, the reduction offer amount, and the final balance on the provider billing ledger.

Step 4: Enter the reduction request offer amount in both places.

Step 5: Change the email address at the very bottom of the page, this should be your email address in case they need to contact you by email or respond to the reduction request.

You will then email or fax the PDF document:

If you email the reduction request, please do the following:

- Attach the document to email.

- CC the negotiator of the case and the client’s filevine email address.

The following is an example of how you should address the provider when emailing the reduction request:

Note: Please follow up with the appropriate provider one week after you send it out, whether it is faxed or emailed.

- Also, please be aware that you will need to follow up with each reduction request until you have received a response. Some providers will accept the reduction offer amount, and some will send a counteroffer.

- If a counteroffer has been provided by the provider, please contact the negotiator immediately and ask them if they wish to accept or if they would like for you to counter with a new offer or stay firm with the original reduction offer amount.

- When you get a counteroffer from the provider, you can respond to the email. If it was written on a reduction request sent via Fax, you can call the provider directly or send another reduction request form with our new counter amount.

Click to download:

CHECKLIST FOR SENDING A CASE FROM

PRE-LIT TO LITIGATION

- Ensure the client has agreed to move forward with litigation and understands what to expect (Fee increase, potential depositions, who the litigation team is)

- Ensure the current accounting is uploaded into the clients file in word format

- Tag the litigation team on filevine and advise them why you feel the case should be moved to litigation and provide them the following information:

- The 3P Adjustors name, phone number, and email

- The current settlement offer from 3P

- Your last counter demand

- What the clients wage loss is and if there are any issues with it

- Issues with treatment gaps

- Serious injuries the client may have

- Issus brought up by the 3P about the case (liability etc)

- Client expectations if available

- What your evaluation of the case is (could it be settled in arbitration (under 100K)? or is it valued higher and would need to be settled in mediation)

- If there is more then one passenger involved as they would need to be included in the lawsuit

- Any other important facts about the case